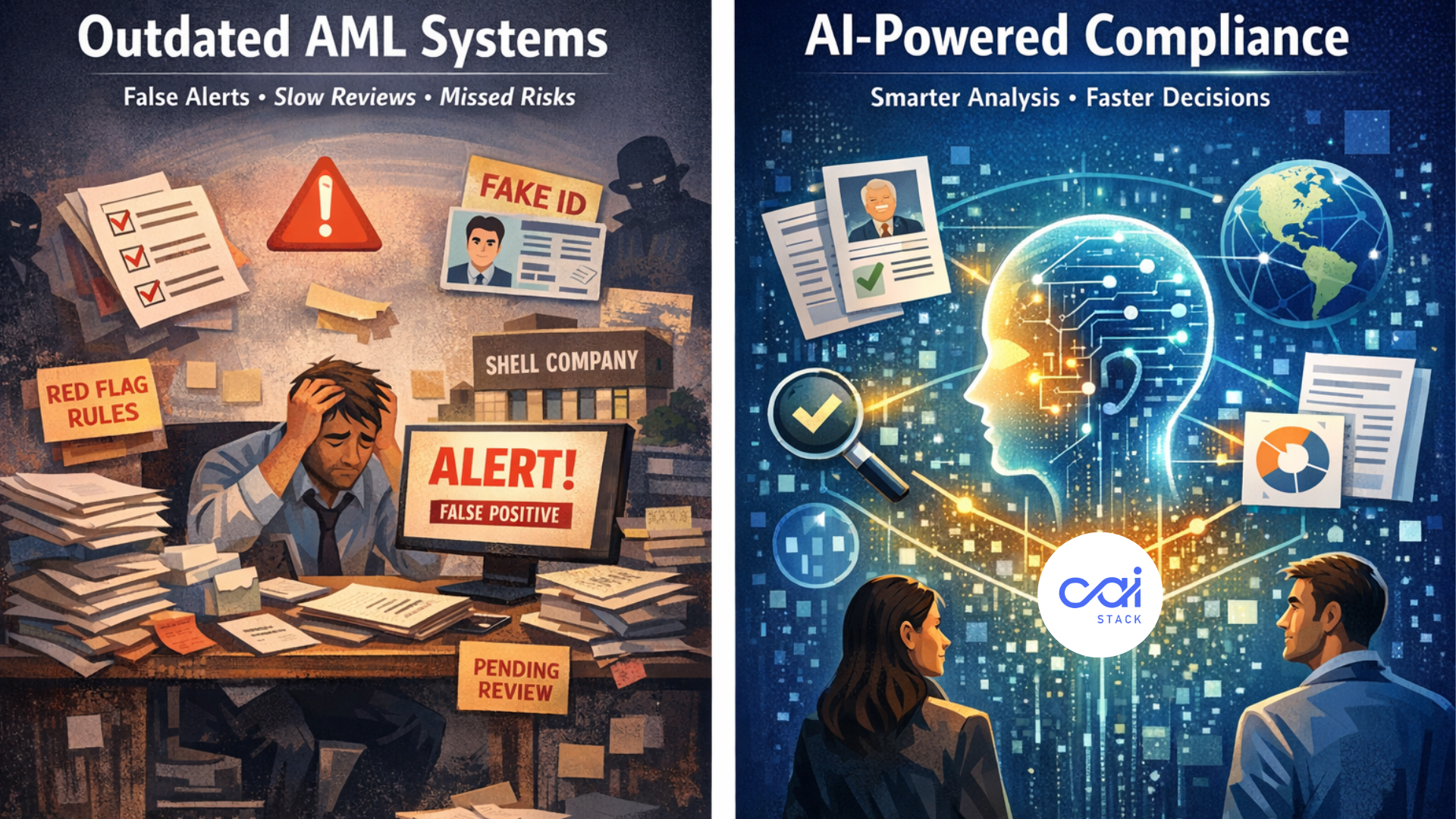

KYC AML compliance teams are drowning in documents. False positives consume many hours. Customer onboarding takes long days. And this happens with almost every finance team.

Traditional rule-based systems flag everything, overlook context, and make your team review thousands of alerts that go nowhere.

Financial crime is getting smarter. Criminals use shell companies, fake IDs, and complex transaction patterns. Your legacy system? It's still checking boxes from 2015.

On the other side, LLMs serve as the intelligence layer that makes sense of unstructured data, spots patterns humans skip, and cuts through the noise.

Let's break down why this matters and how it's changing the game.

Teams spend around 70% of their time on false positives, and hence, onboarding gets delayed. Customers get frustrated. And somehow, actual risks still slip through.

According to industry analysis, traditional AML systems can generate false positive rates up to 95%, meaning nearly all alerts are benign and waste analyst time.

Financial crime compliance is a $61 billion annual expense in the US and Canada alone, and costs continue to rise for 99% of institutions.

Compliance AI adds a brain to your system instead of more rules.

LLMs understand the meaning of the text. They read documents like a human analyst would, but faster and without fatigue.

LLMs read utility bills from any country, verify addresses, cross-reference with government databases, and flag inconsistencies automatically.

Traditional systems generate thousands of alerts. Most are junk.

Instead of keyword matching that flags every "XYZ" in the news, LLMs:

LLMs generate Suspicious Activity Reports (SARs) by analyzing transaction patterns, pulling relevant data, and drafting narratives that explain the suspicious activity in clear language.

What used to take an analyst 4 hours now takes 30 minutes to review and submit.

You're probably thinking: "Okay, but does this actually reduce risk or just move it around?"

Fair question.

LLMs catch things that rules-based systems miss. Period. They understand complex relationships, shell company structures, and subtle red flags that humans might overlook in a stack of 500 alerts.

A leading industry study states that AI-driven compliance improves accuracy and risk detection by combining machine learning with NLP to identify complex money laundering patterns

Every false positive costs time. Every delay in onboarding costs revenue. Companies using LLM-powered systems report:

Do the math on your current volumes.

Regulators expect you to use available technology to prevent financial crime. They're asking: "Why didn't you catch this when you had tools that could?"

LLMs give you defensible, auditable decision-making with clear reasoning chains.

You're spending millions on compliance teams drowning in alerts. LLMs cut manual review time by 40-60%, letting you do more with your current headcount or reallocate resources to higher-value work.

Every day a customer waits for approval is a day they might choose a competitor. LLM-powered KYC compliance systems onboard customers in hours, not days. That's a direct revenue impact.

You'll catch more actual threats with fewer resources. Your SAR quality improves. Your audit findings improve. Your regulatory relationships improve.

LLMs are the intelligence layer that makes your entire compliance stack smarter. They read context. They adapt. They learn. They free your team to do what they do best.

CAI Stack has spent years building compliance AI that functions in production environments. Our AI stack handles millions of transactions, thousands of customer onboardings, and complex risk scenarios every day.

Connect with our team to explore how we can strengthen your KYC compliance operations. Schedule a conversation here.

Subscribe to get the latest updates and trends in AI, automation, and intelligent solutions — directly in your inbox.

Explore our latest blogs for insightful and latest AI trends, industry insights and expert opinions.

Empower your AI journey with our expert consultants, tailored strategies, and innovative solutions.