A safer, customer-centric financial environment with AI-driven fraud prevention, streamlined KYC, and insightful intelligence for smarter decisions and effective risk management.

Onboarding & KYC Automation

Accelerate customer onboarding while meeting global compliance standards. Our intelligent identity verification and KYC automation tools simplify user authentication, reduce drop-offs, and ensure accurate regulatory compliance.

Transform onboarding with intelligent KYC, identity proofing, and customer risk assessment—all powered by AI.

AI Fraud Prevention Suite

Our fraud prevention suite protects financial operations by identifying anomalies, verifying documents, and flagging suspicious transactions in real time.

Detect fraud in real time with AI-driven tools for compliance, onboarding, and risk prevention.

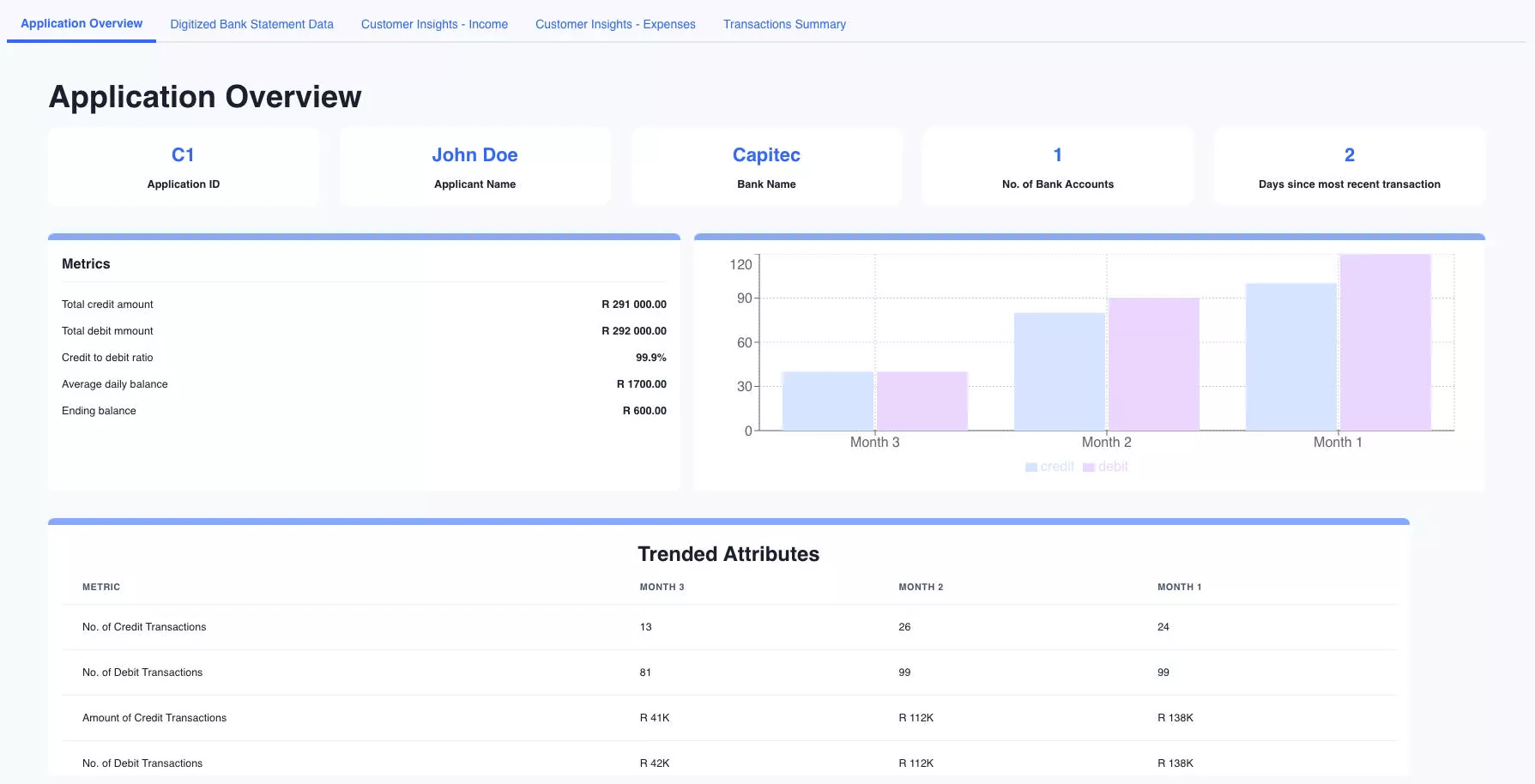

Customer Intelligence

Discover 360-degree visibility into your customer base with predictive segmentation, competitive analysis, and AI-powered intent modeling.

AI-powered customer profiles, behavioral segmentation, and predictive targeting predictive lead scoring to drive smarter financial decisions.

Autonomous Financial AI Agents

Augment your teams with intelligent agents that automate time-consuming financial tasks like data extraction, analysis, and decision support.

Discover actionable insights, automate financial decisioning, and mitigate risk with AI-powered agents designed for research, compliance, document intelligence, and behavioral analysis.

Discover AI-powered solutions revolutionizing finance with automation, fraud prevention, customer insights, and compliance excellence.

Our AI-driven platform combines financial services technology with advanced machine learning for fraud prevention, automated KYC compliance, and data-driven insights that drive smarter decision-making across banking, insurance, and investment sectors.